5 Hotel Sales Strategies to Book More Group Business

100+ months of continuous RevPAR growth has the hotel industry riding an unprecedented high. Meanwhile, group demand continues to grow as we round into the year ahead and, to cap it all off, the supply pipeline is expected to slow. So what does it all mean for hotels looking to grow group business?

The short version: Group demand is there.

The long version: It’s actually a more complex picture when you dive into the details.

For properties and chains looking to develop a cohesive hotel sales strategy for groups and meetings, the long version is key to capitalizing on group demand, booking more meeting space, and bringing in more revenue from each booking. In this post, we’ll dive into the nuances of the segment, laying out five important areas of focus for hotels hoping to grow group sales.

- Optimizing around larger industry trends

- Improving group distribution

- Refining lead management strategies

- Responding with strong event proposals

- Getting more out of group F&B

Step 1: Understand the larger hotel industry trends driving group performance.

Meetings are getting bigger — 22.7% bigger, according to the AMEX Global Meetings Forecast. Since 2009, attendee growth has resulted in every four meeting attendees being joined by a fifth. Meetings themselves, however, have seen somewhat stagnant growth (only 5.4%) over the same period. Meanwhile, 4% of all meetings requiring over 500 room nights contribute 39% of of the entirety of hotel industry group revenue.

The point? The lead pool isn’t growing and the big fish are few. For larger chains especially, it means a more competitive climate that complicates group sales. Today, landing meetings requires a more innovative approach to hotel sales and marketing. Taking those meetings and turning them into repeat business, however, is all about building mutually beneficial relationships with planners.

A great sales strategy incorporates both.

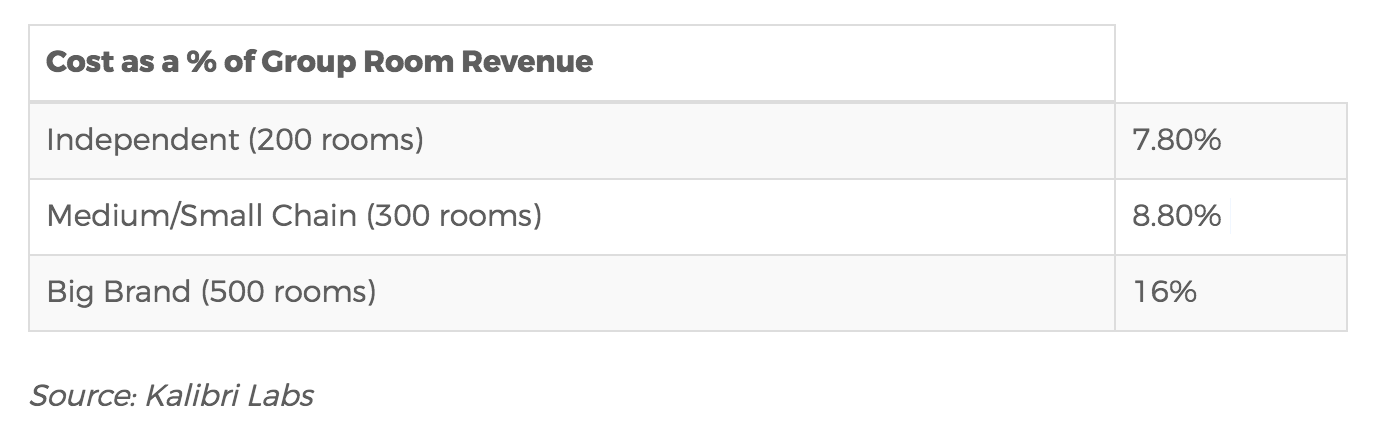

High commissions and group acquisition costs are taking a toll on chains.

Today, when technology, room block processing, intermediary fees, and other similar expenses are factored in, large hotels are shelling out 15-25% of guest-paid revenue to acquire new business. By 2022, this number could be 20-30%.

Larger chains, who usually feature ample meeting space, look to group business as a key revenue driver. Yet this revenue comes at a premium, with 40-60% being intermediated during the sourcing process at fees of 7-10%.

Many chains are cutting their commissions to intermediaries as a result, when looking to the venue sourcing process may prove more effective long-term. Chains ultimately need a better way to connect directly with event planners and bring the meetings product to them.

“Whether or not chains cut commissions, investing in direct group marketing channels opens up an alternative strategy to reduce reliance on third- parties, using technology to bring the meeting product directly to planners.â€Â -Social Tables CEO, Dan Berger

Step 2: Optimize hotel sales and marketing by improving group distribution.

As the focus turns to cost-effective group acquisition, properties are racing to identify and optimize the marketing channels that will prove most effective. A large part of the conversation here is direct booking channels. Leading chains are investing to create channels where planners can book meeting and event spaces without intermediary sourcing — including IHG, who just launched their own group sourcing and booking platform across their portfolio.

This move makes sense for properties and chains of all sizes because:

- It allows them to sidestep commission fees and connect directly with planners.

- Hotels are able to build up a network of planners and improve repeat business.

- Over 50% of planners now do their venue research online.

Improve visibility by being a part of meetings marketplaces.

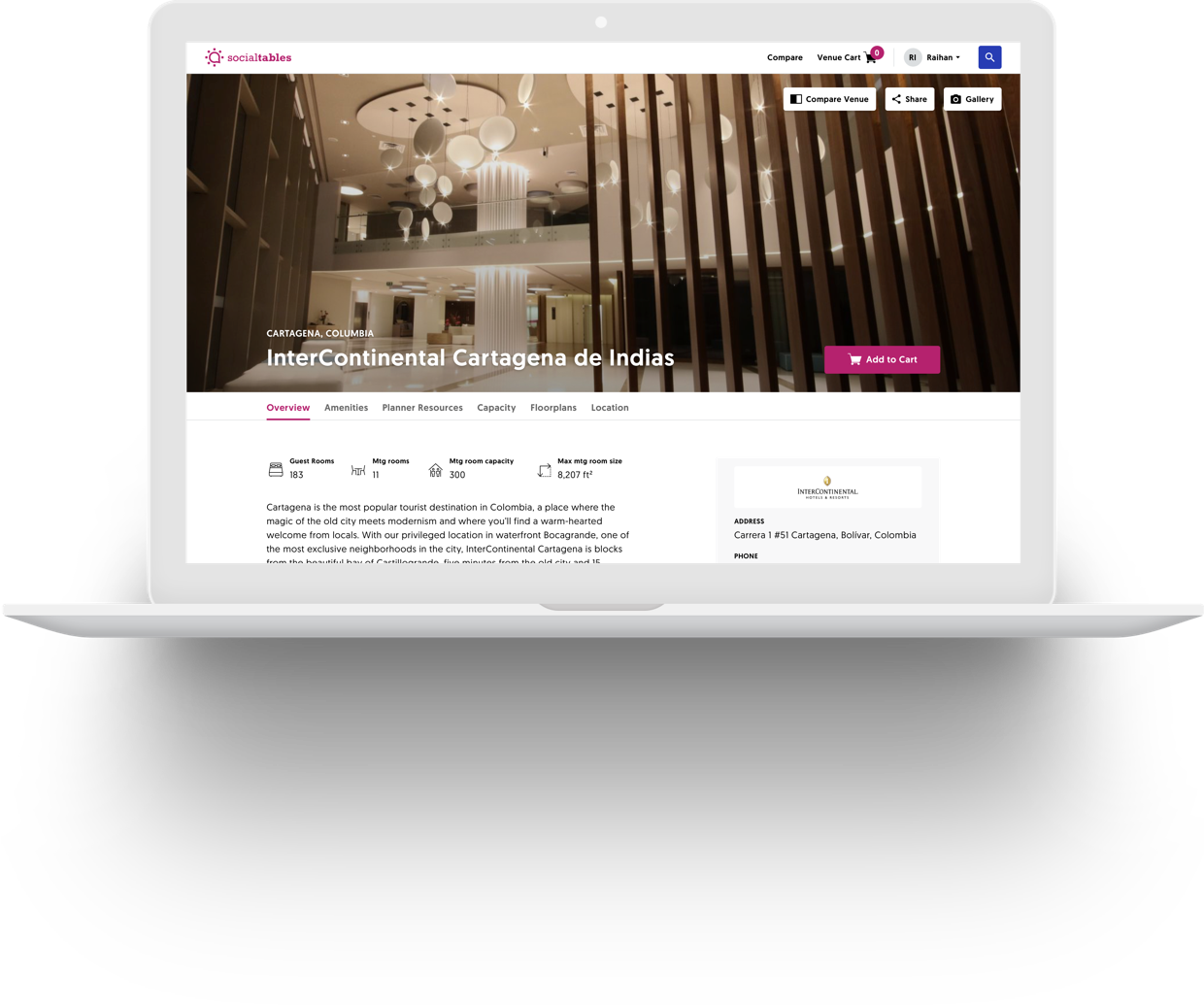

With more than half of event planners saying the web is their primary source for finding and researching potential venues, it’s high time that hotels meet planners where they are. A venue sourcing platform (think of it as venue search engine) can increase a hotel’s visibility to planners while sidestepping OTA fees, and in some cases, reducing sourcing fees.

Platforms like Meetingsbooker.com, Cvent, and Social Tables Search offer technology that allows venues to create a profile like the one below and collect RFPs. Â

What to Include in Your Venue Listing

Showcase the space visually.

1. Accurate floor plans - not every sourcing platform has space for floor plans, but planners find them to be immensely helpful.

2. Quality photos - Photos that show the possibilities inherent in the space, such as photos of event setups, are key to helping planners visualize their event at your hotel.

3. Video - In our survey of planners, 40% said that a video is the most helpful way to digitally visualize a space (50% more than any other answer).

Set your space apart.

What are the differentiating details or unique elements that set your space apart? And more importantly, how can your space help meet the unique objectives of various meeting types.

Use social proof.

By leveraging the success of past events, hotels prove the success of future events in their meeting spaces. Hotels can create a grab-bag of testimonials to use in marketing by encouraging planners to give feedback (both from themselves and attendee surveys) after the event.

[Tweet "Over 50% of planners now do their venue research online."]

Partner with CVBs.

Convention and Visitors Bureaus (CVBs) are local non-profits that are generally funded by a portion of hotel room occupancy taxes. They match planners with hotels and venues based on the specific needs of the event, which means any requests for proposals (RFPs) that come from CVBs are generally more qualified than leads that may come through other sources. Best of all, these qualified leads come at no cost to the property.

Still, when working with CVBs it’s on hotels to equip them with an understanding of the unique assets the property provides, as well as the ways they can help meet specific event objectives. (ex: Is your hotel specially equipped for corporate events that need multiple breakout spaces?)

A good CVB will generally be very in tune with the local knowledge economies of their respective cities. Hotels can leverage this knowledge to strike up beneficial partnerships with local suppliers and align themselves with knowledge assets in their cities to provide more value.

Put event success at the heart of your hotel's group sales strategy.

Helping planners source and create a successful event doesn’t just benefit the planner, it also pays off in large ways for hotels. After all, the more a venue is tailored to the nuances and goals of a given event, and the better equipped planners are, the more chance an event has of successfully meeting its objectives. And when it’s all said and done, successful events are a hotel’s best friend for new and repeat business.

Leading brands are refocusing their marketing accordingly, focusing on showing how they help planners create the ideal experience for attendees. Take the below example from Hilton’s WowMakers campaign, for instance.

Step 3: Improve hotel lead management.

Technology makes the lives of hoteliers much easier, but when it comes to RFPs, it’s also causing sales teams to step up their games. Why? Today, planners can submit an RFP — and in many cases multiple RFPs — with just a few clicks. This has led to a 300% increase in RFP leads from planners over just a span of five years.

When you couple that with growing group demand, it’s a recipe that has properties trying to swim in a sea of never-ending RFPs. And with 75% of proposals being won by the first five properties to respond, that means have to optimize their lead intake, qualification, and response for more speed and efficiency.

As a result of all of this, hotels that want to succeed have to optimize their RFP management in three main areas.

Speed up RFP response.

Luckily, while technology is creating the conundrum, it’s also supplying the solution and catalyzing inquiry response. Response times are resulting dropping from 2+ weeks to under 24 hours, which is becoming the new standard at some leading hotels and chains.

In large part, this is because of automatic lead scoring and RFP response templates that are cutting down on the work it takes to respond.

A quick response not only gets a proposal in front of planners before competitors, it also communicates to them that a property prioritizes their business and is likely to communicate well throughout the process. After all, there’s no second chance at a first impression.

Fine tune your lead scoring.

With more leads, comes the need to pinpoint the most promising inquiries and respond as quickly as possible. Even with an influx of RFPs, opportunity is lost without a smart lead scoring system in place.

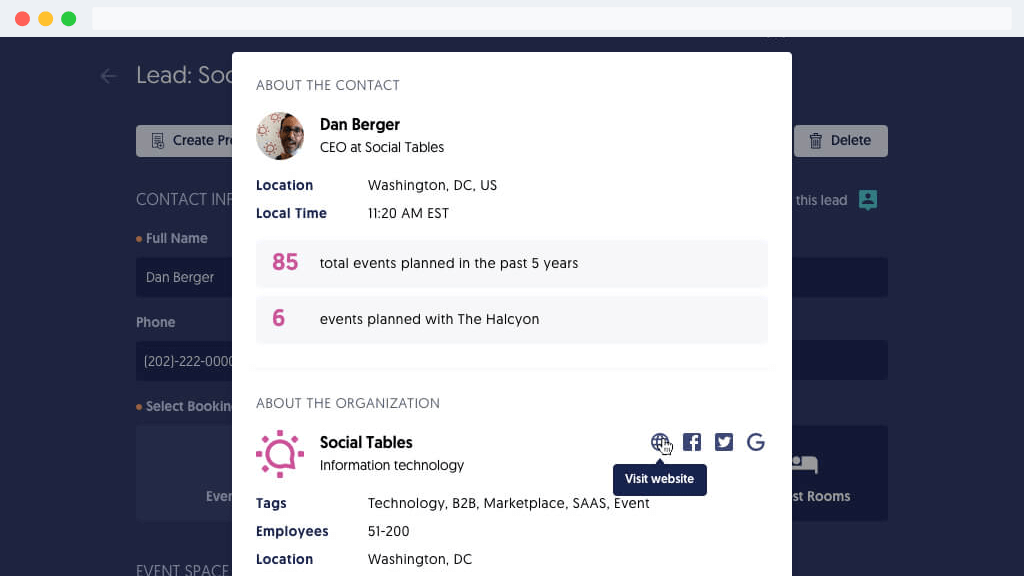

To make it happen, hotels are taking a second look at their internal processes, optimizing response through more intelligent lead qualification. Technology is again playing a huge role, with new systems that automatically score leads as they come in.

Still, While this allows sales teams to focus their talents on response, these systems don’t work well if smart parameters aren’t set. As the hotel CRM of the future evolves, it will identify prospects without the need for these defined RFP management frameworks. Today however, these platforms for the most part only as good as how they’re told to think.

Segment your group business.

No hotel can be everything to every customer. Hotels and chains have to be realistic about the things they can offer well. Just as importantly, they need to pinpoint the right customers to target with those offerings.

Group business doesn’t always get its due diligence. At the end of the day, this means a significantly smaller slice of a $130 billion dollar a year hotel meetings & events pie.

Dividing the broader groups and meetings market into segments forms the foundation for a more targeted approach. Different groups have different needs, different acquisition costs, different timelines, and different profitability.

Identifying which segment’s needs a property can accommodate best, which book frequently, and which are more profitable is the foundation of effective group sales.

Step 4: Optimize RFP response with better proposals.

RFP response is one thing, but effective event proposals are another. No matter how quick a response is, there’s no hope for conversion if the proposal doesn’t do its job well.

Especially in a climate where hotels have to win repeat business for success, the process of event proposals needs to evolve beyond a bidding war to one showing how properties can add value. At the heart of this, is the motivations and preferences of event planners, 37% of whom say bad communication is the number one reason they choose another venue.

Show, don't tell.

When planners are able to visualize the space, they’re able to imagine their event in the hotel — and they have a picture of the perfect event long before they ever send an RFP. Consider that and the fact that 90% of info transmitted to the brain is visual, and it becomes clear that visual communication is the most direct pathway to proving venue viability.

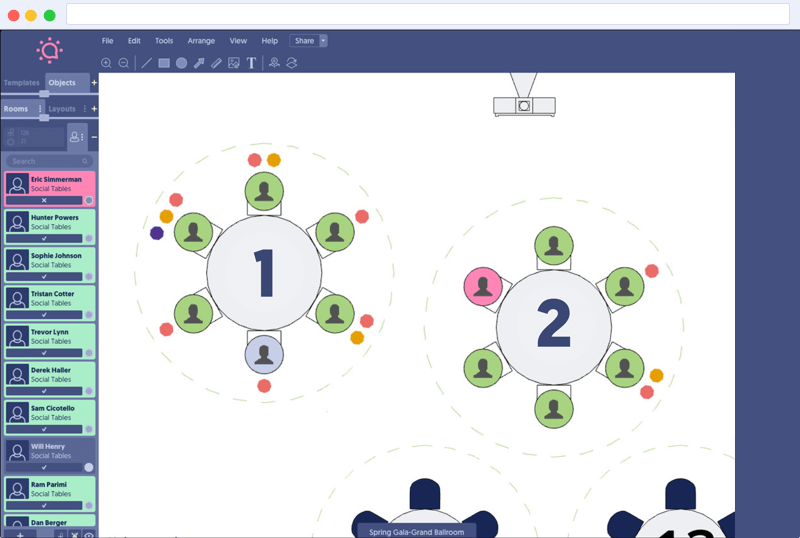

Event diagramming technology allows properties to collaborate with planners in real time and map out each piece of the event to scale — down to where the mics will be placed. Properties are able to create templates of their event spaces and easily update them based on the specifics of the event in question. This allows a sales rep to show the venue will work, demonstrate different layouts, and even communicate upsells visually.

Use past events to prove events will be successful.

A large part of the group sales process is providing peace of mind to prospects. They’re wondering how they’ll get hundreds of people from one room to the next, whether the space will be too tight, and if their vendors will be able to set up easily — amongst so may other things.

A customized site visit is one thing, but that’s not something sales rep can always bank on early on in the proposal process. The next best thing is proving that the space worked for a past, similar event — which should be easy with the right technology. A cloud-based event management solution makes it easy to pull a past diagram and use it as the proof that strikes up a new relationship.

Tap into the purpose and meeting objectives.

80% of event planners today say that their jobs involve more experience creation than just two to five years ago. That push is largely the product of attendee expectations that are shaping the meetings industry. Today, attendees want meetings to have less ballroom and more meaning, innovation, insight, and, most importantly, personalization.

With the new emphasis on purpose, properties need to show they can meet the needs of that purpose or lose out on business. Every piece of the proposal should map back to what an event is trying to achieve on a deeper level. That can’t happen unless properties inquire of planners at the very beginning of the process. (Planners take this as a promising sign!)

[Tweet "80% of planners say their jobs involve more experience creation than 2-5 years ago."]

Step 5: Make hotel F&B a bigger part of your group sales strategy.

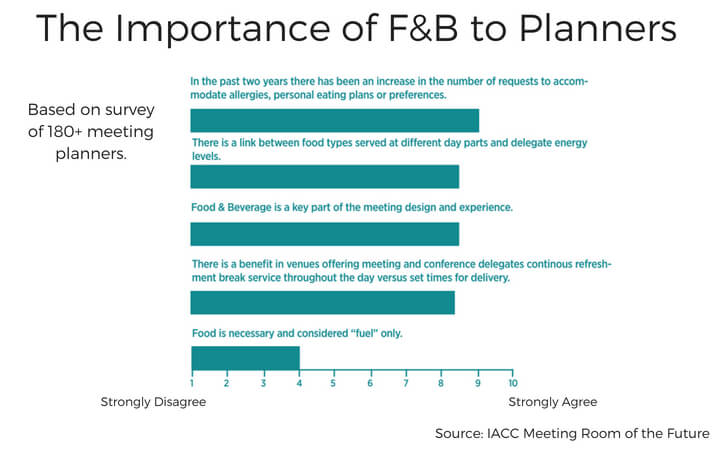

Sure, location and price are the two biggest determining factors in site selection. But the third-ranking answer might come as a surprise: Â In a recent IACC survey of event planners, it was hotel F&B.

That means when planners have multiple venues that might meet their needs from a price or location standpoint, they’re looking to F&B as the difference maker.

With 61% of hotel GMs and F&B Directors planning net growth in catering by the end of the year, it’s clearly growing in importance as a group revenue stream. Why? In large part it’s the margins. Between 2010 and 2016, CBRE reports that F&B profit margin increased from 24.9% to 29.5%.

Especially for higher-tier hotels, it’s a significant revenue driver. In 2017, catering and banquet revenue made up:

- 57% of F&B revenue at luxury hotels

- 59% of F&B revenue at upper-upscale properties

- 58% of F&B revenue at upscale hotels (12)

In the modern world of meetings, the right hotel F&B ideas can make all the difference in year-over-year growth.

[Tweet "Hotels with Social Tables generate 1.82% more F&B profit on average."]

Grow F&B efficiency through event management technology.

Whether it’s improved guest management or a more visual approach to mapping out F&B service, event management technologies are having a big impact on F&B. According to a recent STR study, the right platform can make 1.82% difference in F&B profit for properties when measured on a RevPOR basis.

What's your group sales strategy?

Hotels are committed to group business, and with that commitment comes the need to invest in tactics, tools, properties, and most importantly, partnerships. The demand is there, and by establishing trust and adding value, the revenue will follow. We hope the hotel sales strategies we’ve laid out above give hotels a helping hand in creating their most fruitful year of face-to-face events.

Published October 10, 2018

What’s your group sales strategy for the year ahead? Download our free ebook for 30 pages of compelling stats, case studies, and actionable insights that can help you optimize.